Yields on government debt close flat

YIELDS ON government securities (GS) ended flat last week on mixed trading as the market continued to track domestic inflation and US Treasuries.

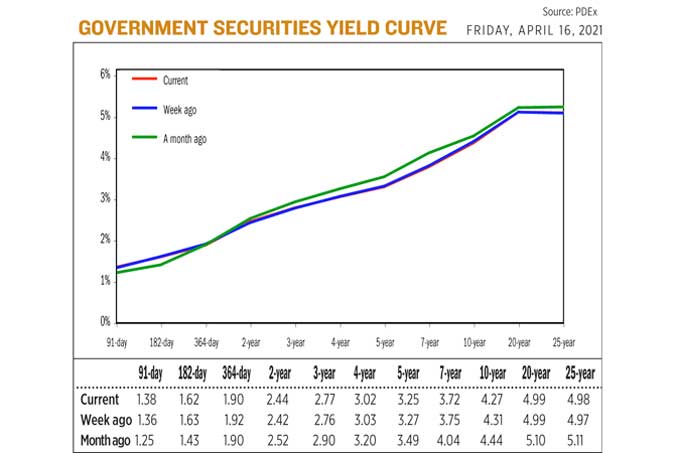

GS yields, which move opposite to prices, went down by 0.46 basis point (bp) on average week on week, based on PHP Bloomberg Valuation Service Reference Rates as of April 16 published on the Philippine Dealing System’s website.

Yield movements of Treasury bills (T-bills) were mixed last week. The rates of the 182- and 364-day papers fell by 0.83 bp and 2.81 bps, respectively, to 1.6197% and 1.8961%. On the other hand, the yield on the 91-day T-bills went up by 2.49 bps to 1.3804%.

A similar trend was seen in the belly of the curve as yields on the four-, five-, and seven-year Treasury bonds (T-bonds) fell by 0.84 bp (to 3.0186%), 1.27 bps (3.2529%), and 2.20 bps (3.7233%), respectively. Meanwhile, the rates of the two- and three-year T-bonds rose 2.44 bps and 0.29 bp to 2.4395% and 2.7662%.

At the long end, the 10-year debt paper saw its yield fall by 3.59 bps to 4.2737%, while the rates of the 20- and 25-year tenors edged up by 0.53 bp (4.9932%) and 0.74 bp (4.9811%), respectively.

“Buying sentiment from the lower-than-expected March CPI (consumer price index) figure [reported on April 6] persisted into [last week],” ATRAM Trust Corp. Head of Fixed Income Jose Miguel B. Liboro said in an e-mail.

Mr. Liboro said the slight decline in US Treasury yields “also contributed to the improvement in buying interest.”

ING Bank N.V. Manila Senior Economist Nicholas Antonio T. Mapa said in an e-mail that local bond yields continued to track the movement of global rates “as inflation concerns subside.”

Inflation eased to 4.5% in March following five straight months of acceleration amid a slower increase in food prices, the Philippine Statistics Authority reported earlier this month.

This brought the year-to-date headline inflation average to 4.5%, beyond the Bangko Sentral ng Pilipinas’ 2-4% target and 4.2% forecast for 2021.

Meanwhile, the yield on US 10-year Treasuries rose 6.6 bps in a late surge to 1.594% on Friday, rebounding from multi-week lows hit the prior session, Reuters reported.

For this week, the market will monitor the Bureau of the Treasury’s auction of seven-year bonds.

“Market will take its cue from [this] week’s bond auction with the market likely to nudge yields lower with inflation expectations more tame than a few short weeks ago,” ING’s Mr. Mapa said.

“We expect rates to adjust slightly higher… and then settle into a consolidation range over the next few weeks. Investors will likely wait for the next inflation print [on May 5] before positioning too aggressively,” ATRAM Trust’s Mr. Liboro added.

Meanwhile, BDO Unibank, Inc. Chief Market Strategist Jonathan L. Ravelas said in a Viber message that he expects interest rates to “move sideways to up in the near-term” following the mixed results last week. — Lourdes O. Pilar